How Much Does GEO Cost?

Optimising for AI Search - The Real Cost of GEO Services

A straightforward breakdown of generative engine optimisation pricing, what you're buying, and when the investment makes sense.

GEO pricing is all over the place right now. That's not a cop-out - it's the reality of a field that's barely two years old in any commercial sense.

If you're researching what to budget for generative engine optimisation, here's what you'll actually find in the Australian market, what drives the variation, and how to think about whether it's worth it.

The short answer

DIY tools and AI visibility tracking software sit anywhere from $50 to $500 a month. Agency services start around $2,000 and go north of $20,000 depending on scope.

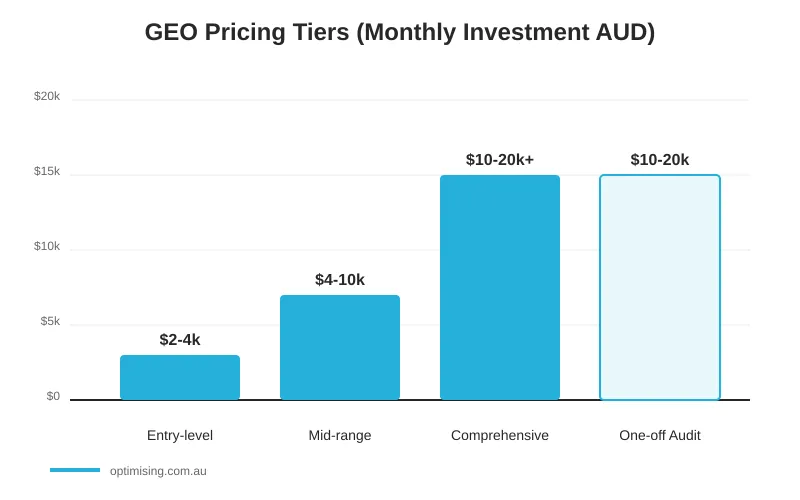

Here's a rough breakdown based on what we're seeing:

- Entry-level packages ($2,000-$4,000/month): Basic content adjustments, some list placements, lightweight tracking. Good for testing the water, but don't expect comprehensive coverage.

- Mid-range programs ($4,000-$10,000/month): Proper AI visibility audits, content optimisation for LLMs, citation monitoring across platforms like ChatGPT, Perplexity and Gemini. This is where most serious work happens.

- Comprehensive strategies ($10,000-$20,000+/month): Full integration with SEO, structured data implementation, competitive tracking, ongoing content programs, and detailed reporting. Enterprise-level stuff.

- One-off AI readiness audits ($10,000-$20,000): A thorough assessment of how AI systems see your site, where you're being cited, where you're missing, and what to prioritise first.

Most agencies haven't standardised pricing because methodologies are still evolving. If someone gives you a fixed price without asking questions first, be cautious.

What are you actually buying?

GEO isn't one thing. It's a mix of technical work, content strategy, and ongoing monitoring. The components that drive cost include:

- Technical AI-readiness assessment - how crawlers from AI platforms see and interpret your site. This covers structured data, content architecture, and whether your information is easy for LLMs to parse.

- AI visibility baseline tracking - monitoring where and how often your brand appears in ChatGPT, Perplexity, Gemini, Google's AI Overviews, and Claude. This is harder than it sounds because there's no equivalent of Google Search Console for AI engines.

- Competitive gap analysis - understanding who's winning citations in your category and why. Often it's not who you'd expect.

- Content optimisation - adjusting existing content so it's more likely to be referenced, and creating new content that answers the questions AI tools are pulling from.

- Ongoing monitoring and reporting - the landscape shifts constantly, so you need regular visibility into what's working.

What drives the price variation

The gap between a $3,000 quote and a $15,000 quote usually comes down to a few things:

- Site complexity. A 50-page services site is a different job to a 10,000-SKU ecommerce catalogue.

- Number of markets. Tracking AI visibility across Australia is one thing. Adding the US, UK and Southeast Asia multiplies the work.

- Depth of competitor analysis. Surface-level snapshots are cheap. Proper competitive intelligence takes time.

- Standalone vs integrated. GEO that sits alongside a broader SEO program is more efficient than running it as a separate stream.

- Platform coverage. Monitoring one AI engine costs less than tracking five.

Is it worth it?

This is the question everyone's really asking.

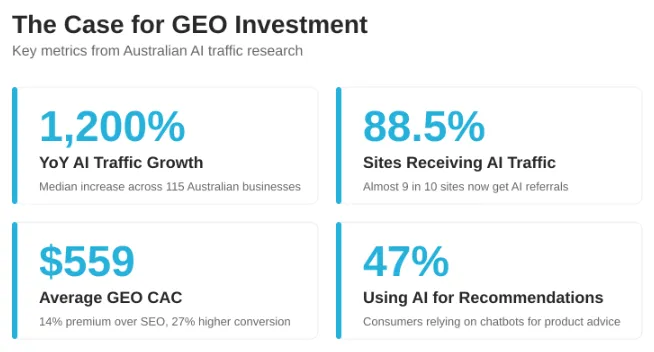

We ran a study earlier this year looking at AI traffic across 115 Australian businesses (Australian AI Traffic Study). The findings were clear: AI search is real and growing fast.

The median year-on-year increase in AI-referred sessions was 1,200%. Almost nine in ten sites (88.5%) now receive traffic from AI platforms. ChatGPT drives the most volume, but Perplexity and Gemini show higher purchase conversion rates on smaller numbers.

AI's share of total traffic is still small - we're talking fractions of a percent for most sites - but the growth curve is steep. It looks a lot like early mobile adoption: negligible at first, then compounding quickly as platforms mature.

On the ROI side, research from First Page Sage suggests GEO delivers an average customer acquisition cost of $559 across industries - roughly 14% higher than traditional SEO, but with 27% higher conversion rates and better lead quality. Their data covers 127 B2B companies over 18 months, so it's one of the more credible benchmarks available.

Adobe's 2024 consumer survey found 47% of people already use AI chatbots for product or service recommendations. That number will only climb.

How we approach it

At Optimising, we don't treat GEO as a bolt-on. It's integrated into how we think about SEO now.

Our AI Readiness Audits give you a clear picture of where you stand - how AI platforms see your site, where you're being cited, where competitors are winning, and what to prioritise. From there, we can scope ongoing work based on what actually makes sense for your business.

We're also tracking AI visibility across all client accounts as standard. It's part of how we report on search performance, not an optional extra.

If you're planning a site migration, GEO considerations should be built in from day one. We treat migrations as both a search and AI exercise now, keeping Google and AI tools aligned on your new site.

When to invest

If you're already strong in traditional SEO, you've got a head start. Good content, clean technical foundations, and solid authority all translate to AI visibility.

If competitors are consistently winning citations in your category, you're already behind.

If you're sitting on the fence waiting to see how this plays out, that's fair - but the gap between leaders and laggards is widening every quarter.

The best starting point is understanding where you actually stand. That's what our AI Traffic Study was designed to show at a market level. An audit does the same for your specific situation.

James Richardson

Co-Founder

James is Co-Founder of Optimising who’s worked with everyone from national retailers and franchise groups to fast-growing eCommerce brands. He’s as interested in how AI engines send traffic as he is in old-fashioned rankings, and spends a lot of time testing how brands show up across search.

He started out running sports fan sites and early eCommerce stores, picked up a few senior sales and marketing roles at ASX-listed companies, then decided to build the kind of SEO agency he actually wanted to work at. Outside work, James is usually being out-negotiated by his three daughters, hosting very serious pretend tea parties, or supervising yet another cubby house build in the lounge room.