AI Traffic in Australia: What the Data Actually Says

Using first party data from 115 Australian brands, this study shows how much traffic AI search is driving today, how fast it is growing, and where it is actually converting.

The short answer on AI traffic in Australia

Key numbers on growth, revenue share, and platform performance

AI search is now influencing how Australians find brands. The effect is small but growing fast, and it doesn’t look the same for every business.

This study covers 115 Australian businesses from September 2024 to September 2025 (inclusive), measuring AI-referred visits from platforms including ChatGPT, Perplexity, Gemini, and Claude. Note that this is before AI Mode was released in Australia.

Growth is obvious but can still vary greatly between websites in our sample. Some sites now see regular AI visits, while others see only a trickle. Our results are presented to reflect the typical site experience and potentially avoid outlier noise.

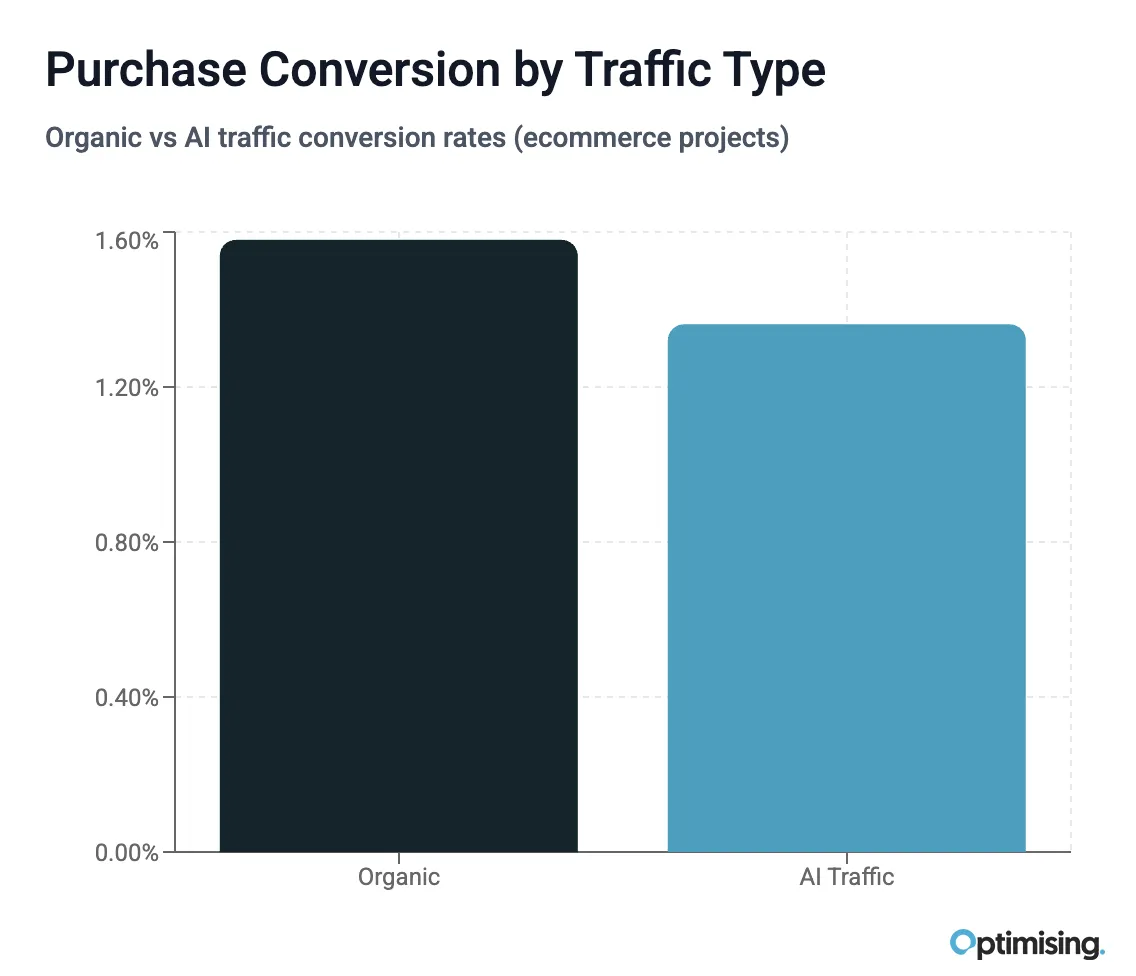

Ecommerce shows rising visit volume but weaker funnel performance than organic. Add to cart and purchase rates are lower, and Average Order Value is slightly lower.

Service businesses show a different pattern. The early signal is more brand appearances inside answers and more branded or direct navigations, while measured AI referrals remain modest.

This study was run to put numbers on a topic clients keep asking about and to set a clean baseline before even more growth.

Key findings

- AI growth is steep but uneven. September YoY AI sessions: +1,200% (median); September MoM: +18.8% (median).

- AI revenue share (ecommerce): ~0.1% across the sample so far.

- Funnel (AI median vs Organic):

- Add-to-Cart: 16.2% vs 27.4%

- Purchase rate: 2.9% vs 6.0%

- By-platform performance:

- ChatGPT drives most identifiable AI traffic but converts the worst

- Perplexity and Gemini users convert 3-6x higher than ChatGPT

- Platform composition varies by site and directly affects overall AI conversion

What’s in this report

A plain-language analysis on how AI is affecting discovery and traffic across Australian brands, what the current numbers actually say, and where the shape of change is most obvious.

About the dataset

- Period: September 2024 to September 2025 (inclusive)

- Sample: 115 businesses

- 61 ecommerce

- 54 service or lead-generation

- Total traffic analysed: 24.8 million sessions

- Industries: retail, fashion, home improvement, professional services, healthcare, tourism, education and trades

- Identification via known referrers and parameters

- Some AI journeys mask referrers or resolve as Direct/Organic, so totals are conservative

Methodology

Data was drawn from GA4 across Optimising-managed accounts with at least 12 months of consistent tracking. AI-driven sessions were identified using known referrers and parameters for ChatGPT, Perplexity, Gemini, and Claude, plus tagged AI Overviews where available. Because some AI journeys mask referrers or resolve as Direct or Organic, the totals here are conservative.

How AI is changing discovery across the sample

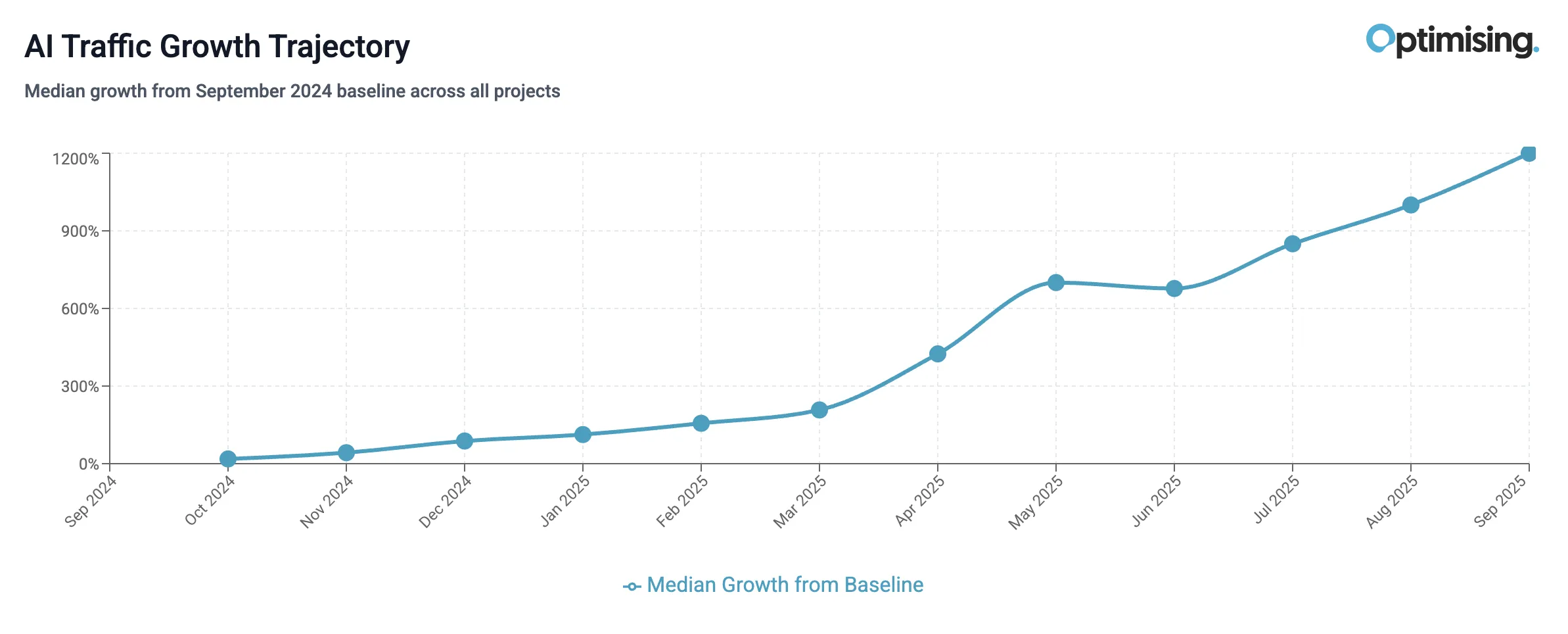

AI’s share of total traffic remains small, yet the growth curve is unmistakable.

- Sep YoY AI sessions: +1,200% (median)

- Sep 3mo AI sessions: +50% (median)

- Sep MoM AI sessions: +18.8% (median)

The pattern looks like early mobile adoption: negligible at first, then compounding as platforms mature and content becomes easier for AI to interpret.

The growth curve is unmistakable, even if not every brand feels it yet.

The spread is wide. Some businesses see regular AI clicks now, while others see little beyond sporadic visits and answer-box mentions. A small group is pulling strongly ahead, most often where catalogue depth or content breadth gives AI systems more to work with.

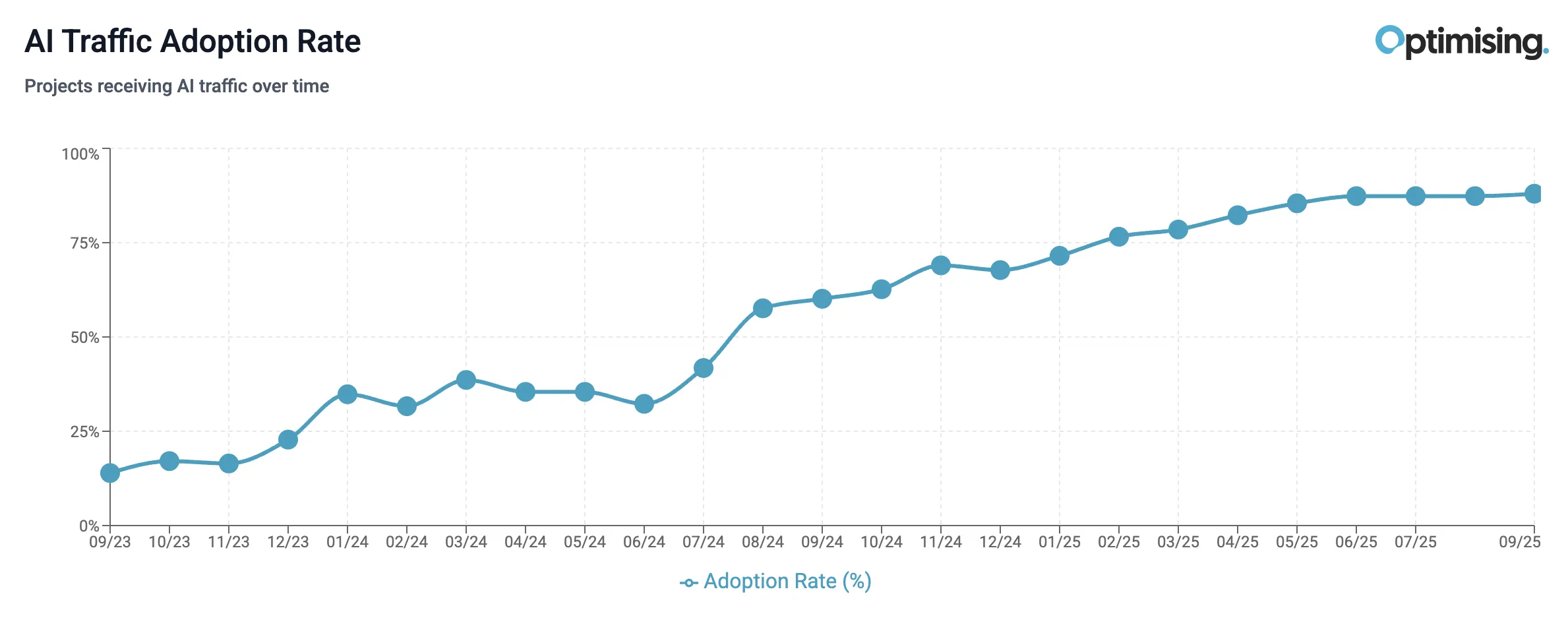

Coverage across projects

AI traffic isn’t just growing - it’s spreading. What started as a handful of visits is now a standard footprint across most sites and sectors.

Projects with any AI traffic

- 2023: 13.5%

- 2024: 60.3%

- 2025: 88.5%

That’s 531.8% growth in projects with AI traffic over two years.

Broader coverage means AI discovery has moved from edge case to everyday reality.

Results by Platform

ChatGPT Dominates

ChatGPT drives by far the most identifiable visits, but has the weakest purchase conversion rate. Perplexity and Gemini send fewer users who convert several times higher.

- ChatGPT: 90.2%

- Perplexity: 4.25%

- Gemini: 2.5%

We anticipate that the upcoming Shopify integration into ChatGPT will further cement ChatGPT as the leading AI platform for ecommerce.

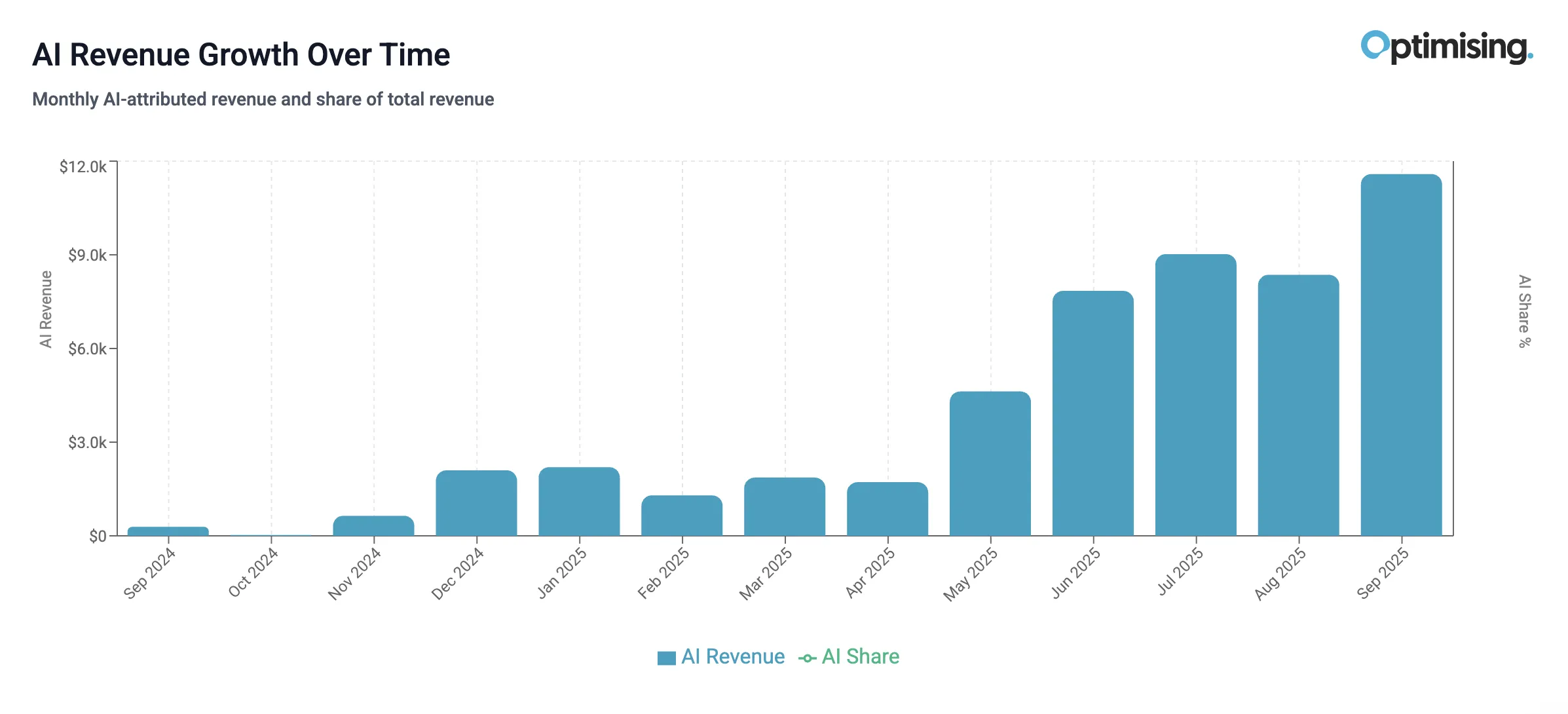

Ecommerce: early volume, lagging monetisation

The ecommerce picture has two parts.

First, volume exists. Since the September 2024 baseline, we’ve recorded 41,335 AI sessions, 332 transactions, and $48,705 in AI-attributed revenue.

Second, conversion lags. Compared with organic traffic, AI users add to cart less often (16.2% vs 27.4%), complete purchases at a lower rate (2.9% vs 6.0%), and spend slightly less per order ($146.70 vs $160.65).'

Ecommerce at a glance

- AI revenue share: ~0.1%

- Funnel (AI vs Organic)

- Add-to-Cart: 16.2% vs 27.4%

- Purchase rate: 2.9% vs 6.0%

- AOV: $146.70 vs $160.65

- Platform effect

- ChatGPT drives the most traffic, lowest conversion

- Perplexity and Gemini has a 3–6× higher conversion than ChatGPT

ChatGPT accounts for the majority of identifiable AI visits in our data but converts worse. Perplexity and Gemini send fewer users who convert several times higher. In other words, “AI” is not one channel with one behaviour, the blend of sources shows up directly in the funnel.

These numbers might shift though, and quickly. Shopify and OpenAI have announced native commerce inside ChatGPT, enabling purchases directly in-chat without redirects.

If adoption is strong like we expect, ChatGPT traffic should carry more buyer intent than it does today.

Yes, AI revenue is tiny right now, but the trend is the point: revenue is beginning to follow session growth, and with better buying mechanisms and a stronger platform mix, the gap to organic will narrow.

Service businesses: visibility before clicks

Service-led brands experience AI differently. Referral sessions from AI remain modest for most, but brand surfacing inside answers is clearly rising. The names that appear tend to be the ones with consistent details, clear descriptions of what they do and where, and credible third-party proof. The dynamic feels like digital word-of-mouth: inclusion first, traffic later.

This creates a slightly awkward analytics story. Mentions are not always easy to quantify, and not every cited search carries a referrer. This means the measured AI share looks flatter than the actual influence on discovery. Being named when someone asks for a local specialist is where the momentum starts.

Interpreting varied growth

To give context to our findings, it’s worth talking to why we’re seeing variation in numbers.

“Uneven” means some sites lift quickly while others barely move. AI platforms tend to surface brands with stronger signals like a recognisable name, consistent identity across the web, verified Australian presence, steady recent reviews, and third-party coverage. A well-known footwear brand with consistent details across its site, Google Business Profile and major directories, active review velocity, and mentions on trusted outlets will be cited far more often than a low-recognition store with inconsistent branding, few reviews, and little third-party presence.

In addition, many AI-assisted journeys also arrive without an AI referrer, so they log as Organic or Direct.

The totals are therefore conservative, and variation across sites is expected.

Limitations and bias

- The sample draws from brands that already invest in search, which likely over-represents organisations with stronger data hygiene and content coverage.

- Masked referrers and cross-device behaviour under-count AI-assisted journeys.

- Revenue samples for some platforms are still thin, so platform-level conversion rates should be read as directional rather than definitive.

- GA4 model differences and attribution windows apply.

Even with those caveats, the scale of sessions analysed and the consistent month-over-month lift across industries make the trend hard to ignore.

Final thoughts

AI search is now a small but accelerating slice of discovery in Australia, and it’s already reshaping where attention lands.

- Our study shows a +1,200% YoY median increase in AI traffic

- Almost all websites in our study have received AI traffic (88.5%)

- Compared to other AI platforms, ChatGPT drives by far the most traffic, while Perplexity and Gemini show much higher purchase rates on a smaller volume of visits.

- Ecommerce purchase conversions slightly lags Organic (for now)

With AI Mode now live in Australia, expect the compounding to continue as both platform coverage and adoption improve.

Special Thanks

This has been the first time Optimising has put together a first party data analysis for public use and it has been a team effort.

Huge thanks to our SEO and AI Lead, Tom Lutrov for the original concept, and pulling together all the data for this project.

And a big thanks to everyone I have shown this to for feedback before publishing.

Need help with an AI focused strategy?

Own generative search. Optimising can plan and deliver GEO and AI campaigns that lift visibility where it matters.

James Richardson

Co-Founder

James is Co-Founder of Optimising and has been working in SEO for over 20 years, across everything from complex site migrations to multi-location franchise rollouts. These days he spends just as much time thinking about how brands show up in ChatGPT and Perplexity as he does about Google rankings. He started out running sports fan sites and early eCommerce stores before building the kind of SEO agency he actually wanted to work at.

Outside of work, he's usually being out-negotiated by his three daughters or supervising yet another cubby house build in the lounge room.